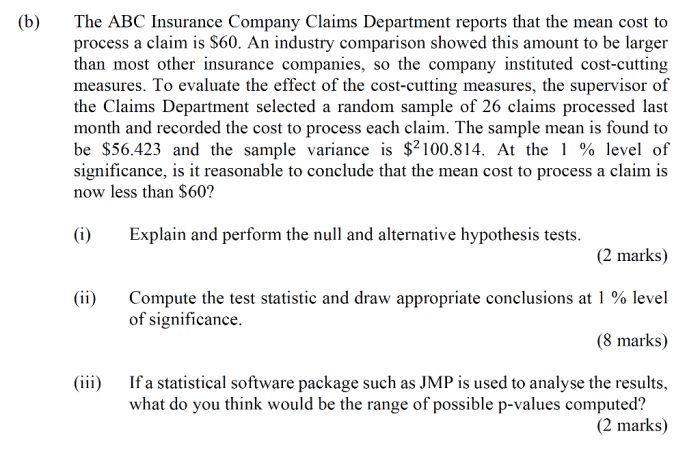

Abc insurance company transfers part of their risk to xyz – ABC Insurance Company, a leading provider in the insurance industry, has recently embarked on a strategic risk transfer partnership with XYZ, a specialized risk management firm. This move is a testament to the evolving landscape of risk management and the growing need for insurance companies to optimize their risk portfolios.

This partnership enables ABC Insurance to transfer a portion of its underwriting risk to XYZ, allowing the company to enhance its capital efficiency and focus on its core competencies. XYZ, with its expertise in risk assessment and mitigation, will assume the responsibility of managing and reinsuring these risks, providing ABC Insurance with greater flexibility and resilience.

Risk Transfer Overview

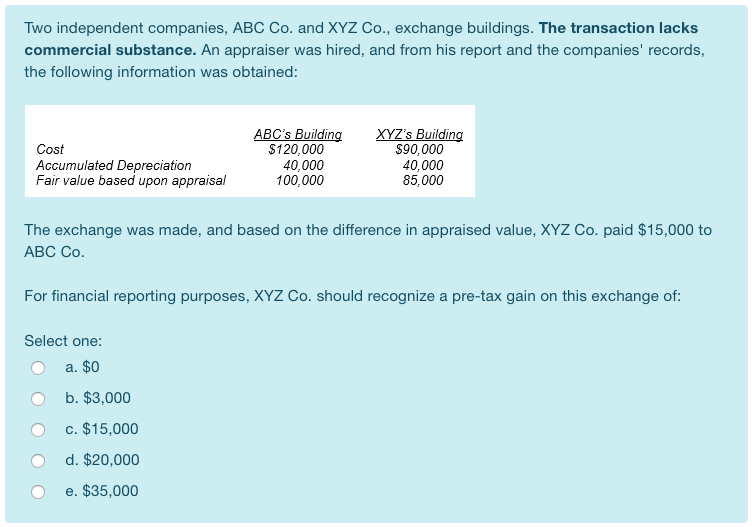

Risk transfer is a fundamental concept in insurance. It involves the transfer of financial risk from one party (the policyholder) to another party (the insurer). This transfer of risk allows policyholders to protect themselves from potential financial losses in exchange for paying a premium to the insurer.

There are various methods of risk transfer, including:

- Insurance: The most common method of risk transfer, where individuals or businesses purchase insurance policies to cover specific risks.

- Reinsurance: A form of risk transfer where insurers transfer a portion of their risk to other insurers.

- Hedging: Using financial instruments to offset the risk of price fluctuations or other market movements.

- Diversification: Spreading risk across different investments or assets to reduce the impact of any single loss.

Risk transfer offers several benefits, including financial protection, peace of mind, and the ability to manage risk more effectively. However, it also has some drawbacks, such as the cost of premiums, potential exclusions or limitations in coverage, and the need for careful consideration and understanding of the terms and conditions of the risk transfer agreement.

ABC Insurance Company’s Risk Transfer: Abc Insurance Company Transfers Part Of Their Risk To Xyz

ABC Insurance Company has identified several specific risks that it is transferring to XYZ, including:

- Catastrophic events: Risks associated with large-scale events such as natural disasters or terrorist attacks.

- Long-tail liabilities: Risks that may not manifest for many years, such as environmental or product liability claims.

- Concentration risk: The risk of excessive exposure to a particular industry, sector, or geographic region.

ABC Insurance Company is transferring these risks to XYZ for several reasons:

- To reduce its overall risk exposure and improve its financial stability.

- To free up capital that can be used for other purposes, such as expanding into new markets or developing new products.

- To gain access to XYZ’s expertise and capabilities in managing these specific risks.

The process of risk transfer from ABC Insurance Company to XYZ involves a formal agreement that Artikels the terms and conditions of the transfer, including the specific risks being transferred, the amount of risk being transferred, and the compensation that XYZ will receive for assuming the risk.

XYZ’s Role in the Risk Transfer

XYZ plays a crucial role in the risk transfer agreement with ABC Insurance Company. As the assuming party, XYZ assumes the risks that have been transferred from ABC Insurance Company.

XYZ brings several capabilities and expertise to the partnership, including:

- Strong financial capacity and risk management capabilities.

- Specialized knowledge and experience in managing the specific risks being transferred.

- Access to global markets and resources.

XYZ will benefit from the risk transfer by:

- Diversifying its risk portfolio and reducing its overall risk exposure.

- Generating additional revenue through the premiums received from ABC Insurance Company.

- Expanding its market presence and building stronger relationships with insurance companies.

Impact on Policyholders

The risk transfer from ABC Insurance Company to XYZ has the potential to impact ABC Insurance Company’s policyholders in several ways:

- Coverage: The specific terms and conditions of the risk transfer agreement may affect the coverage that ABC Insurance Company offers to its policyholders.

- Premiums: The cost of insurance premiums may change as a result of the risk transfer, depending on the terms of the agreement and the overall risk exposure of ABC Insurance Company.

- Communication: ABC Insurance Company is responsible for clearly communicating the risk transfer to its policyholders, explaining any changes to coverage or premiums, and addressing any concerns or questions.

ABC Insurance Company should take proactive steps to inform policyholders about the risk transfer, provide clear explanations of any changes, and ensure that policyholders understand their rights and options.

Regulatory Considerations

The risk transfer from ABC Insurance Company to XYZ must comply with all applicable regulatory requirements.

Regulatory considerations include:

- Insurance regulations: The risk transfer must comply with the insurance regulations of the relevant jurisdictions, including requirements for financial stability, solvency, and risk management.

- Antitrust laws: The risk transfer must not violate any antitrust laws or regulations that prohibit anti-competitive practices.

- Tax implications: The risk transfer may have tax implications for both ABC Insurance Company and XYZ, and it is important to consider the tax consequences of the transaction.

ABC Insurance Company is responsible for ensuring that the risk transfer complies with all applicable regulatory requirements and for obtaining any necessary approvals or permissions from regulatory authorities.

Commonly Asked Questions

What are the benefits of risk transfer for insurance companies?

Risk transfer allows insurance companies to optimize their capital allocation, reduce their exposure to large losses, and enhance their financial stability.

What role does XYZ play in the risk transfer agreement?

XYZ is responsible for managing and reinsuring the risks transferred from ABC Insurance, providing the company with specialized expertise and capacity.

How will this risk transfer impact ABC Insurance’s policyholders?

The risk transfer is expected to have minimal impact on policyholders, as ABC Insurance will continue to provide the same level of coverage and service.